It’s a pleasure to announce the successful completion of QIAGEN’s acquisition of Exiqon AS. Welcome to our new colleagues!

Exiqon is a world leader in RNA technology and the company has developed and successfully commercialized comprehensive RNA technology solutions that fit seamlessly into QIAGEN’s Sample to Insight portfolio. Together we expect to deliver a broad and industry leading offering of molecular biology solutions – spanning sample technologies, assay technologies, and bioinformatics.

For more details on the transaction, please read the official press release below.

Press release

QIAGEN announces successful completion of tender offer for shares in Exiqon

Transaction will enhance leadership position in RNA solutions from Sample to Insight

Venlo, The Netherlands, June 23, 2016 – QIAGEN N.V. (NASDAQ: QGEN; Frankfurt Prime Standard: QIA) today announced the successful completion of the conditional, voluntary public tender offer for the shares in Exiqon A/S, a world leader in RNA technology. The extended Offer Period expired yesterday, on 22 June 2016, at 23.59 (CET).

QIAGEN N.V. has in total received acceptances from shareholders in Exiqon A/S representing 34,852,938 shares or approximately 94.52% of the share capital and voting rights in Exiqon A/S. The Offer will be settled in cash through the shareholders in Exiqon's own custodian banks and will be effected as soon as possible, but not later than 28 June 2016. QIAGEN N.V. will apply for a delisting of the shares of Exiqon A/S and intends to initiate a squeeze-out of the remaining minority shareholders immediately after completion of the offer.

"We are very pleased to have completed this transaction and will now initiate the integration process", commented Peer M. Schatz, Chief Executive Officer of QIAGEN N.V. "We welcome our new employees to the QIAGEN family and look forward to providing the exciting benefits of the now combined portfolio to research and diagnostic laboratories."

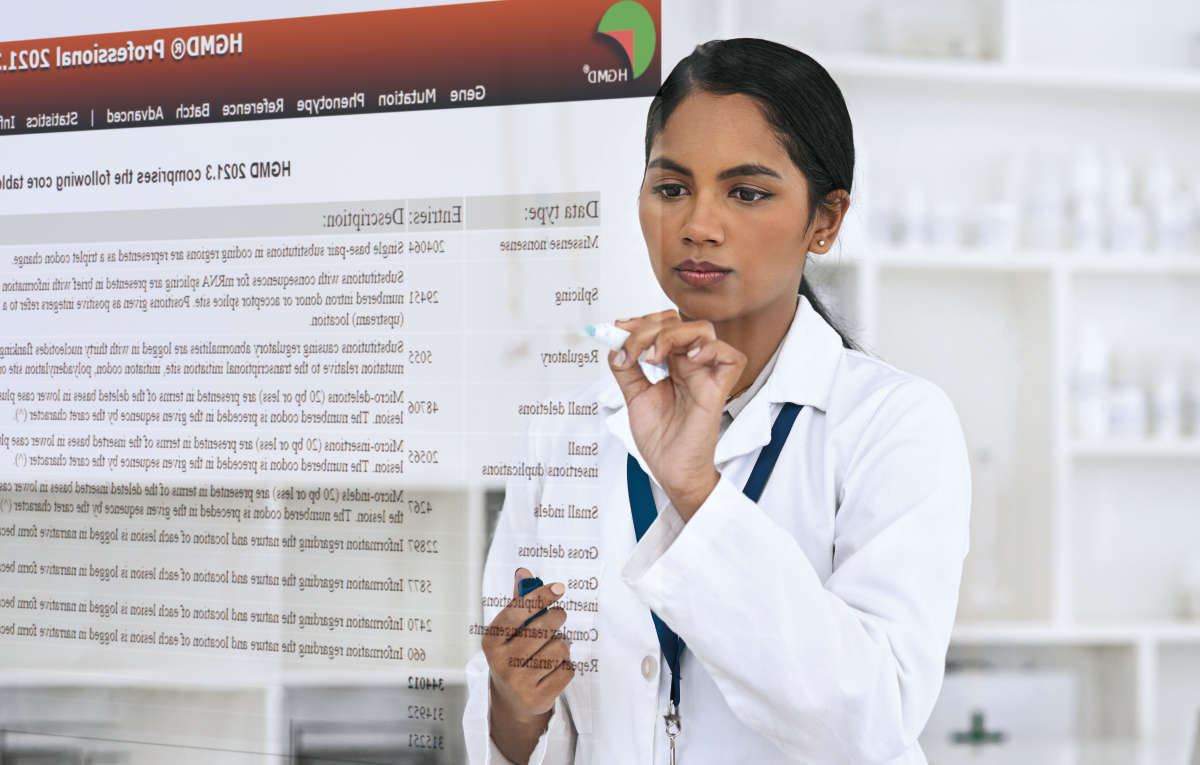

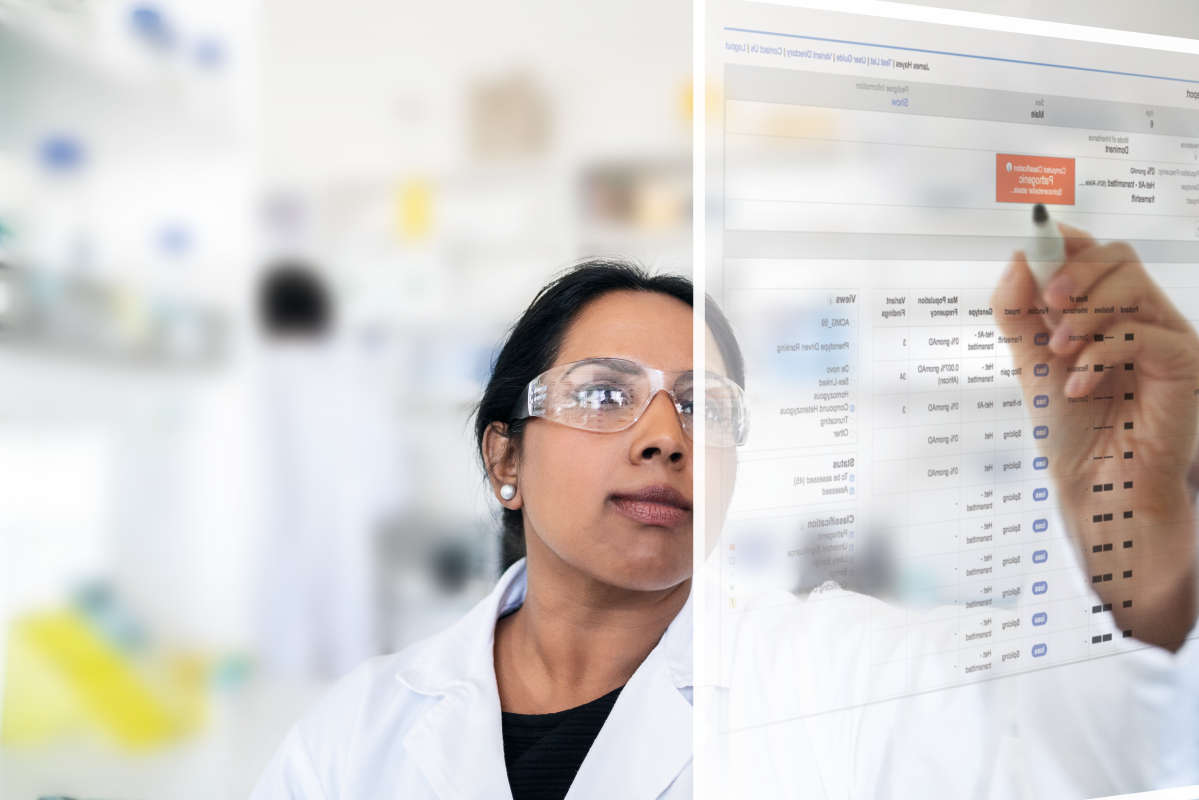

Exiqon has a strong position in the promising new market of non-coding RNA (ncRNA). The company has developed and successfully commercialized comprehensive RNA technology solutions that fit seamlessly into QIAGEN’s Sample to Insight portfolio. Together with Exiqon, QIAGEN expects to deliver a broad and industry leading offering of molecular biology solutions – spanning sample technologies, assay technologies, and bioinformatics.

Transaction background

On 18 April 2016, QIAGEN had published a conditional, voluntary public tender offer for the shares in Exiqon A/S, in which the shareholders were offered a cash amount of DKK 18 for each share they held in the company. This Offer period had been extended on 19 May 2016 and on June 3 at unchanged terms and conditions. On 8 June 2016, QIAGEN announced its decision to change the offer conditions, reducing the acceptance threshold from 90% to 89.20%.

The total consideration to fully acquire Exiqon is estimated at approximately DKK 683 million. Based on a currency exchange rate of DKK 1.00 = $0.150 (market rate as of March, 29, 2016), the transaction is valued at approximately $100 million.

Details of the financial impacts will be announced on QIAGEN’s next earnings call held on July 29.

Barclays is financial adviser to QIAGEN in connection with the Offer and Danske Bank A/S is acting as settlement agent.

Special information for United States residents

The Offer is subject to the laws of Denmark. The Offer relates to the securities of a Danish company and is subject to the disclosure requirements applicable under Danish law, which may be different in material respects from those applicable in the United States. The Offer is being made in the United States in compliance with Section 14(e) of, and Regulation 14E promulgated under, the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), and otherwise in accordance with the requirements of Danish law. The Offer is not subject to Section 14(d)(1) of, or Regulation 14D promulgated under, the Exchange Act, and is made in reliance on the exemption provided by Rule 14d-1(d) thereunder.

About QIAGEN

QIAGEN N.V., a Netherlands-based holding company, is the leading global provider of Sample to Insight solutions that enable customers to gain valuable molecular insights from samples containing the building blocks of life. Our sample technologies isolate and process DNA, RNA and proteins from blood, tissue and other materials. Assay technologies make these biomolecules visible and ready for analysis. Bioinformatics software and knowledge bases interpret data to report relevant, actionable insights. Automation solutions tie these together in seamless and cost-effective workflows. QIAGEN provides solutions to more than 500,000 customers around the world in Molecular Diagnostics (human healthcare), Applied Testing (forensics, veterinary testing and food safety), Pharma (pharma and biotech companies) and Academia (life sciences research). As of March 31, 2016, QIAGEN employed approximately 4,600 people in over 35 locations worldwide. Further information can be found at http://www.qiagen.com.

Certain statements contained in this press release may be considered forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. To the extent that any of the statements contained herein relating to QIAGEN's products, collaborations, markets, strategy or operating results, including without limitation its expected adjusted net sales and adjusted diluted earnings results, are forward-looking, such statements are based on current expectations and assumptions that involve a number of uncertainties and risks. Such uncertainties and risks include, but are not limited to, risks associated with management of growth and international operations (including the effects of currency fluctuations, regulatory processes and dependence on logistics), variability of operating results and allocations between customer classes, the commercial development of markets for our products to customers in academia, pharma, applied testing and molecular diagnostics; changing relationships with customers, suppliers and strategic partners; competition; rapid or unexpected changes in technologies; fluctuations in demand for QIAGEN's products (including fluctuations due to general economic conditions, the level and timing of customers' funding, budgets and other factors); our ability to obtain regulatory approval of our products; difficulties in successfully adapting QIAGEN's products to integrated solutions and producing such products; the ability of QIAGEN to identify and develop new products and to differentiate and protect our products from competitors' products; market acceptance of QIAGEN's new products and the integration of acquired technologies and businesses. For further information, please refer to the discussions in reports that QIAGEN has filed with, or furnished to, the U.S. Securities and Exchange Commission (SEC).