The digital transformation of healthcare is happening at an increasingly rapid pace. However, while many other industries are capturing the vast potential of artificial intelligence (AI) to revolutionize their work, healthcare hasn’t yet reached the level of digitization to allow it to leverage these next-generation tools and capabilities. To capitalize on the opportunities of this advanced analytics era, healthcare must raise its digital trajectory.

DeciBio Insights sat down with Dr. Ramon Felciano, Chief Technology Officer and Vice President of Strategy at QIAGEN Digital Insights, to discuss the current state of healthcare digital transformation, what healthcare companies need to be doing right now, and how QIAGEN's digital health strategy is setting the stage for a decade of progress.

Q: Companies with molecular diagnostics capabilities like QIAGEN, Roche, and Abbott have increasingly made moves to play in the “digital health” arena. How important is development of a digital health strategy for molecular diagnostics players, and why?

If any organization of significant size in any industry doesn’t have a digital strategy at this point, it’s arguably irresponsible. Andreessen coined the tagline “software is eating the world” nearly a decade ago, and it’s certainly been proven across many industries. The advent of digital technology, the internet, mobile devices, and the software industry as a whole, is changing every other industry out there. The molecular diagnostics industry is no different.

I know that every player certainly has a strategy for effectively leveraging these technologies in-house — that is, to what extent can bioinformatics, clinical informatics, the cloud and IT solutions drive productivity and innovation of their own product line. Beyond in-house development, I would speculate that many technologies that were previously only available through healthcare providers (e.g., through a doctor’s office or clinical lab) will start to become more consumer-accessible and available at home, and digital will play a role in making that happen.

Part of what’s going to enable this innovation are things like smartphones and ubiquitous connectivity that lower barriers to entry, can help ensure healthcare tools are used safely and effectively, and route health data back to the providers and healthcare system to help manage a patient’s care and wellness over time. We’re still in the early days and there’s a lot of exciting innovation going on.

Q: What do you see as the key unmet needs in genomics or real-world multi-omics (i.e., paired molecular and real-world clinical data) that digital technologies have the ability to address? Among the current digital approaches to tackling these unmet needs, what are the most significant remaining challenges?

It pains me to say it, but genomic interpretation — making sense of genomic data to the point where you can act on it — is still a significant challenge for many organizations, in both research and clinical settings. Many organizations still struggle to get value out of the money they spend on running genomic studies and generating data, so there’s still a lot of room to continue raising the bar. Helping everyone get to these genomically driven insights is one of the core areas QIAGEN is focused on.

But moving beyond that molecular focus, in the real-world data or evidence space, people have been trying to link molecular data sets with non-molecular data sets for decades and it’s really hard. Projects face challenges with data quality, how linkable different data sets from different data providers are, how complete the datasets are in data and metadata, and whether if you plug them all together, the aggregate data set still has enough statistical robustness to be able to actually run useful analytics or extract meaningful insights out of it.

What you find in a lot of cases is that it isn’t — there are too many holes and gaps in the data. It’s quite challenging to find three different data sets from three different organizations, bring them together, and get something of significantly higher value out of it, unless those organizations have coordinated along the way.

Q: Can you speak a bit more about how molecular diagnostics companies are thinking about navigating that dilemma?

Molecular diagnostics companies like QIAGEN typically don’t see or treat patients directly. In many cases, we may not sell directly to physicians either, as we reach them indirectly through the molecular testing labs we empower with our products. So we maybe two or three “hops” away from the people we’re ultimately trying to help, making improvements in patients' lives indirectly. However, we’re increasingly seeing the need to partner with our lab customers to improve the value delivered back into the care continuum.

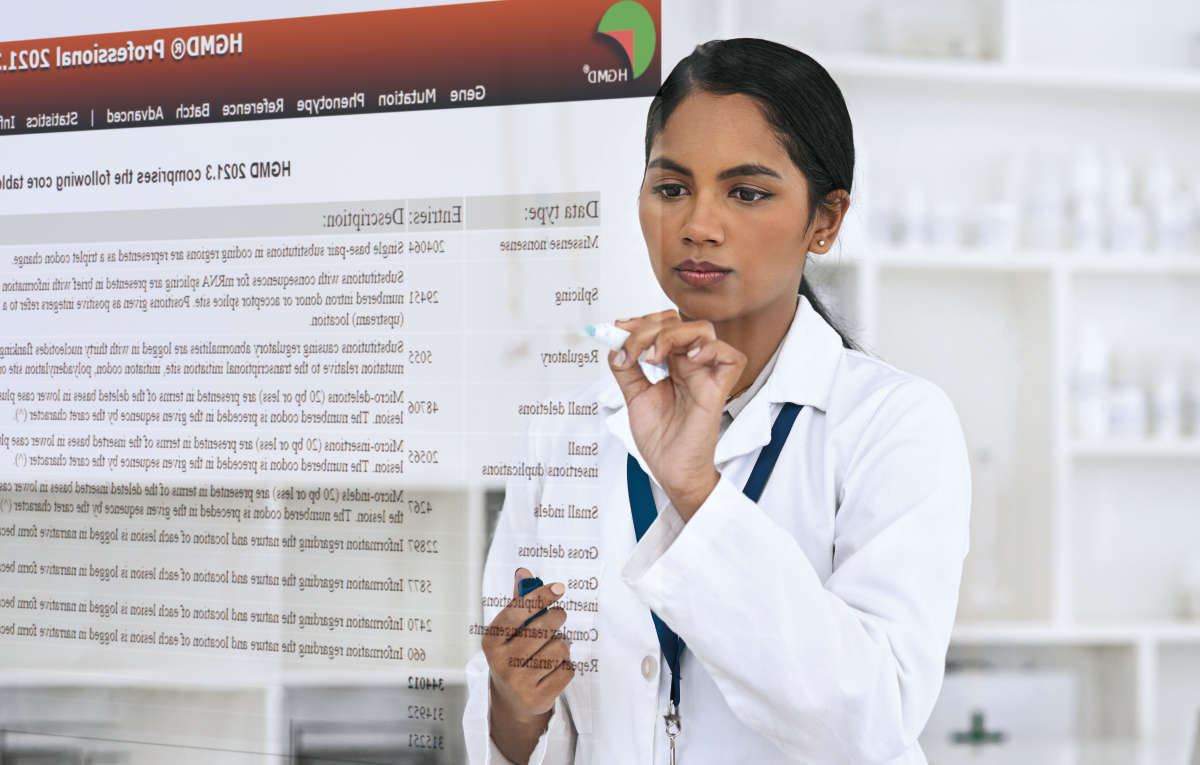

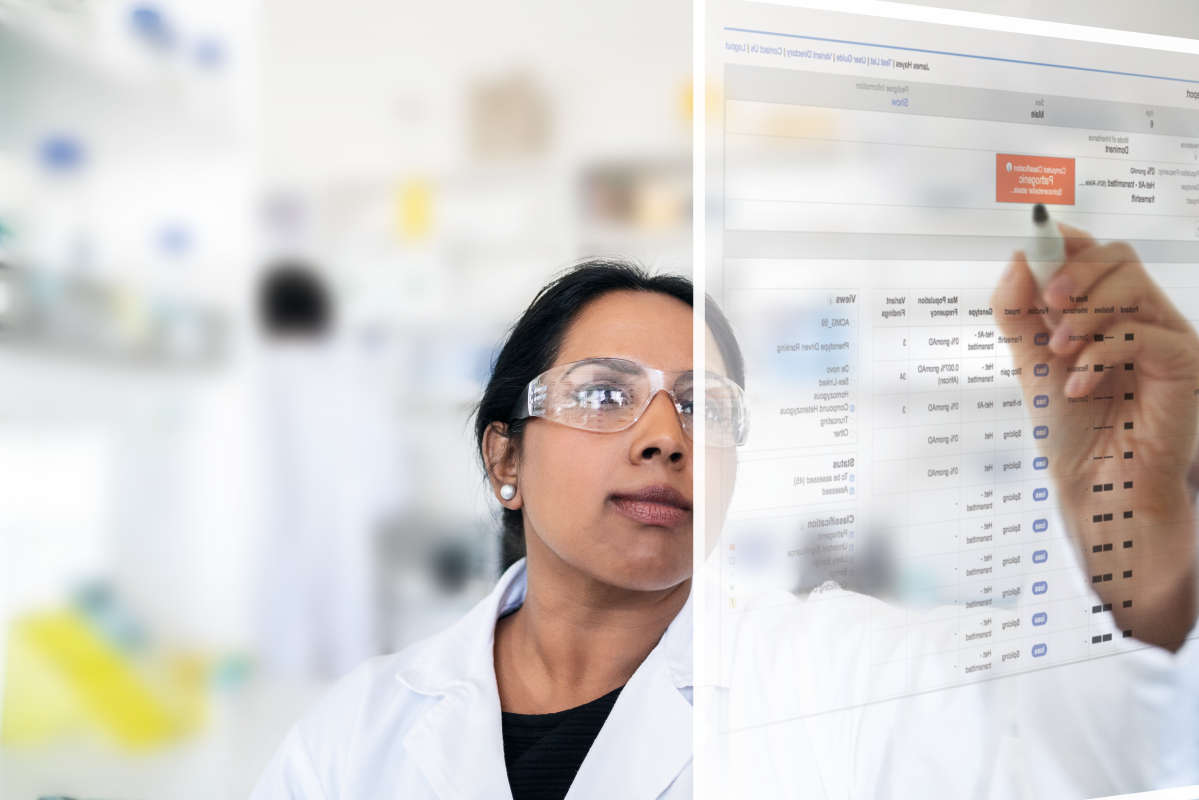

For example, precision medicine insights often require sophisticated interpretation of patient genomes that may be beyond the capabilities for many practicing physicians, placing greater demands on labs to provide targeted, actionable guidance as part of their test report. Our QIAGEN Clinical Insights product line provides targeted decision support capabilities to help labs perform these in-depth interpretations on behalf of ordering physicians to quickly turn around a personalized genome report that is accurate and actionable.

We are also working hard to get better insights into outcomes impacted by such precision medicine efforts to drive the entire innovation engine at QIAGEN forward. Getting a handle on the clinical outcomes is central to value-based healthcare, and to accelerate digital innovations in healthcare, we may need new thinking on how to best capture, access, and use those value measures.

"Getting a handle on the clinical outcomes is central to value-based healthcare, and to accelerate digital innovations in healthcare, we may need new thinking on how to best capture, access and use those value measures."

COVID has also shed light on some of the hurdles, and in some cases, barriers, to integrating clinical and genomic data sets in from different sources,. The privacy, regulatory, and legal landscapes around healthcare data and data sharing, especially internationally, have absolutely slowed down our ability to innovate and drive research in response to the pandemic.

If I could wave a magic wand and introduce one game-changer into the world, it’d be to have some sort of international regulatory and privacy mechanism in place that would allow one to decide within 24 hours whether or not to share a data set with another research group, and to then have them immediately get access to the data. If we could easily and responsibly pool data for COVID patients at the level of both the molecular assay data and clinical records being collected worldwide, I suspect it might accelerate our ability to detect and treat this disease. The Global Alliance for Genomic Health (GA4GH), of which QIAGEN is a member, is working hard driving the policy and regulatory frameworks to make this happen. I would encourage anyone interested in these problems to engage with that global effort.

Q: Zooming out and thinking back to the early days of the QIAGEN Digital Insights team, what were some of the key guiding principles your team used to develop a digital health strategy?

The QIAGEN Digital Insights group includes all of our traditional bioinformatics products and services focused on research and discovery markets; our more recent efforts in the clinically-focused precision medicine space; and now includes our efforts to explore the real-world insights space. Our products have been supporting the pharma and academic research communities for 20-25 years, and the translational and precision medicine areas for 5-10 years.

"Our products have been supporting the pharma and academic research communities for 20-25 years, and the translational and precision medicine areas for 5-10 years."

The expansion into real-world data (RWD) applications was arguably a logical evolution of our core QIAGEN Digital Insights business as more genomic insights made their way out of specialized molecular biology labs and into the hands of physicians and caregivers who are increasingly savvy about genomic medicine. We saw the same thing happening on the pharma side, as they were trying to leverage these molecular data sets more effectively to drive downtime and costs for their trials. We looked at those industry challenges and clearly saw that it was the next step for how we could bring our data, expertise, and track record to create value around molecular data to the clinical trial side of pharma.

This next wave of innovation will require bridging over to the clinical patient data. That’s not an area QIAGEN has played heavily in: we don’t have a medical records product division and our customer base has traditionally been labs instead of hospitals. For the next big wave of value to come out of genome data, we have to move beyond the specialty genomics organizations to reach and deliver value to a broader base of clinical professionals, both in primary care and in pharma, who are working to deliver new drugs to market.

One thing that is becoming very clear to us is that many of the same foundational data challenges we saw on the research side appeared to also be true on the clinical side. There’s a hunger and need for high-quality data that someone has secured, collected, cleaned up, and organized into a useful format and schema.

High-value tools and algorithms can then take that data and translate it into actionable and insightful results that will help a business make better decisions. Maybe it’s helping kill a clinical trial earlier than it otherwise would’ve been under a “fail faster” model, or selecting the best clinical sites for your trials based on knowledge of where you’re more likely to find the patients with the clinico-genomic profile you seek to enroll, and so forth. For us, the real-world insights space is a good match because we have core competencies in taking messy, disorganized, heterogeneous data and massaging it into the right, high-quality form such that you can then build high-value digital products on top of it.

Q: Has QIAGEN encountered any challenges developing a digital health strategy that balances the need to be specific enough to be actionable with the need to be broad and adaptable enough to meet the market as it evolves?

I think this whole market is so new and evolving that there’s a level of rate of change and uncertainty that you have to be comfortable with if you’re going to be an early market player.

Something that QIAGEN has done to help us on this front is expand and further develop our informatics, software, and data product lines— that is, the digital products side of QIAGEN’s business — are in a separate business unit. While we integrate with a number of QIAGEN’s assay offerings, QIAGEN Digital Insights is a fundamentally distinct division within QIAGEN. Because of that, we’re running it like a fully digital business.

The RWD space still has a bit of “wild wild west” to it—we’re still very early, and we expect to see quite a bit of evolution in how that opportunity plays out. But we’re excited about that–we signed up to help overcome these challenges when we decided to move into this space.

Q: Is there any collaboration or cross-talk between QIAGEN’s Molecular Diagnostics and Digital Insights teams to see where there might be mutually beneficial opportunities to pursue?

Absolutely. QIAGEN has had a corporate strategy called “Sample to Insight” for several years now that specifically looks to leverage QIAGEN’s competencies across assays, instrumentation, and the digital side of the business to deliver unique value to both life sciences and molecular diagnostics customers.

We have cross-business unit collaborations where we’ve innovated, designed, developed, and gone to market with examples of this sort of end-to-end value proposition, both for research and academic discovery customers but also on the companion diagnostic (CDx) side in helping design and develop better companion diagnostics for pharma to deliver to market alongside one of their new therapeutics. Sample-to-Insight is a central pillar of our strategy.

Q: Thinking broadly and futuristically, what do you think the world of “digitally-augmented” molecular diagnostics will look like in 20 years?

I would bet that we’ll see lots of ways to package up some of these molecular assaying technologies for use at-home. I’m waiting for someone to come up with the “molecular diagnostic toilet bowl”, where your toilet is wired up and runs a series of molecular screens every time you use the restroom. Setting aside possible squeamishness of contemplating such a product, it makes sense to have molecular testing become part of routine life.

I suspect in the 10-20 year time frame, we’ll see some of this on our phones as well. They already measure motion and sound and light; there’s no reason why we couldn’t eventually have molecular measurement as well, for example, sweat from fingers on touch screens. Companies who are really good at building these increasingly high-powered devices are putting more sensors in there already and I suspect they’re will expand into biological sensors at some point as well.

There are so many different ways of bringing molecular measurement capabilities into our homes. We have to shift our perspective to start thinking, “Where are there opportunities to intervene and measure something clinically useful through whatever products we have in front of us in our daily lives?”

"We have to shift our perspective to start thinking, “Where are there opportunities intervene and measure something clinically useful through whatever products we have in front of us in our daily lives?”"

Q: As comical as it is, your molecular diagnostic toilet bowl idea makes a really great point about leveraging existing home “devices”. Do you think the shift of testing into the home or the hands of patients will ultimately be driven by the value of RWD to pharma or diagnostics companies who would make these solutions affordable for consumers so they can harvest the data, or whether you could see payors reimbursing this kind of testing?

I might live to regret that analogy. For the toilet bowl, there’s first obviously some technological innovation questions (e.g., “How do you build a toilet bowl with such measurement capabilities, ideally able to be installed and serviced without a specialty commercial workforce”), but maybe more readily accessible would be any device that you could imagine having in a person’s home that already has part of the physical infrastructure required to measure what you want. I know a number of groups that, not surprisingly with COVID, are looking at in-home air purifiers and asking if we can use them to screen for pathogens in the air as well.

One of the bigger challenges for many MDx players may be the lack of direct reach to the consumer. The question from a go-to-market standpoint is, “How would you get this out into people’s homes, and what is the thing you’d be trying to put there?” If I were to take a swing at this, channel partnerships are likely an important part of the strategy, where you can leverage existing players with consumer reach to manage this risk for you. For example, partnering with the manufacturer that has the best air purifiers, or partnering with cell phone manufacturers interested in exploring the “molecular sensor onboard” opportunities.

Payors will also play a role, but that will differ by geography. I think once you get to a certain level of critical mass, your go-to-market can be accelerated by getting reimbursement and coverage approved, but at least in the U.S., I think the innovation itself will have to come out of either a start-up or from organizations that have a particularly effective innovation framework, whether that’s in-house or through partnerships. It might be a different story in countries where centralized healthcare authorities may be able to directly stimulate innovation and novel approaches to diagnosis and treatment for their patient populations. But in the US, I would look to the startup ecosystem as the most fertile ground for driving these innovations forward.

Visit our QIAGEN Clinical Insights (QCI) and QIAGEN Real-World Insights pages to learn more.

Content of this blog taken from "DeciBio’s Q&A with Ramon Felciano, Ph.D., CTO & VP of Strategy for QIAGEN Digital Insights", July 2020.

References: